Top 12 Best Free Online Business Tools for Startups / Small Businesses (Year 2023)

Financial Management Tools at a glance ( quickbooks vs freshbooks vs expensify ):

Any company must manage its funds effectively. Accounting activities are made simpler by tools like invoicing, spending monitoring, and financial reporting offered by QuickBooks and FreshBooks. Employees can easily submit expense reports and collect receipts thanks to Expensify’s streamlined cost management.

QuickBooks: Streamlining Financial Management

The goal of QuickBooks is to make small business financial administration as simple as possible. It enables businesses to handle invoicing, cost tracking, payroll, and more on one unified platform thanks to its user-friendly interface and robust capabilities.

Key Features:

- Invoicing: Create expert invoices, distribute them to customers, and monitor payment progress.

- Expense Tracking: Keep track of and classify business expenses by associating them with particular clients or projects.

- Financial Reports: Create thorough financial reports that include cash flow statements, balance sheets, and profit and loss statements.

- Payroll: Process payroll for employees, compute taxes, and produce tax forms.

- Integration: Real-time data syncing can be accomplished by easily connecting to bank accounts and other financial apps.

Practical Use Case:

An independent graphic designer can use QuickBooks to track design material costs, invoice clients, and produce reports to assess the financial health of their business.

FreshBooks: Simplifying Accounting for Small Businesses

Another user-friendly cloud-based accounting program designed for freelancers and small business owners is FreshBooks. It provides features to manage billing, tracking expenses, time tracking, and more, making it simple for businesses to keep their finances in order.

Key Features:

- Invoicing: Accept online payments, set regular invoices, and create personalized invoices.

- Expense Management: For simple organizing, keep track of business spending, categorize them, and include receipts.

- Time Tracking: Log billable hours and automatically transform them into invoices.

- Client Portal: Online viewing and payment of bills by clients enhances communication and payment processes.

- Reporting: Create financial reports like tax summaries, expense reports, and profit and loss statements.

Practical Use Case:

A web development studio can use FreshBooks to track project-related expenses like hosting and domain prices, issue thorough invoices to clients, and appropriately bill clients for the hours spent on various projects.

Expensify: Revolutionizing Expense Management

Expensify is a cutting-edge cost management platform that makes expense reporting for organizations easier. It contains features that make expense tracking and management simple, including automated receipt scanning, expense approvals, and reimbursement procedures.

Key Features:

- Receipt Scanning: Utilize the OCR capability of the mobile app to capture and digitize receipts.

- Expense Categorization: Expenses can be automatically categorized and assigned to particular projects or categories.

- Approval Workflows: To ensure accuracy, provide unique approval procedures for expense reports.

- Direct Reimbursement: Employees should be paid promptly through ACH transfers or other payment options.

- Integration: For smooth data flow, sync with accounting programs like QuickBooks and Xero.

Practical Use Case:

Expensify can be used by a sales team on a business trip to scan receipts for lodging, food, and travel. The software automates categorizing expenditures and providing reports to the finance division for approval and payment.

More effective tracking, reporting, and decision-making can result from incorporating programs like QuickBooks, FreshBooks, and Expensify into your small business’s financial management plan. These platforms provide the functionality and ease required to maintain the accuracy and organization of your financial procedures.

The potential operation of the subscription plans is described below:

Choosing a pricing plan that meets your company’s needs is often required when subscribing to accounting and cost management software like QuickBooks, FreshBooks, and Expensify.

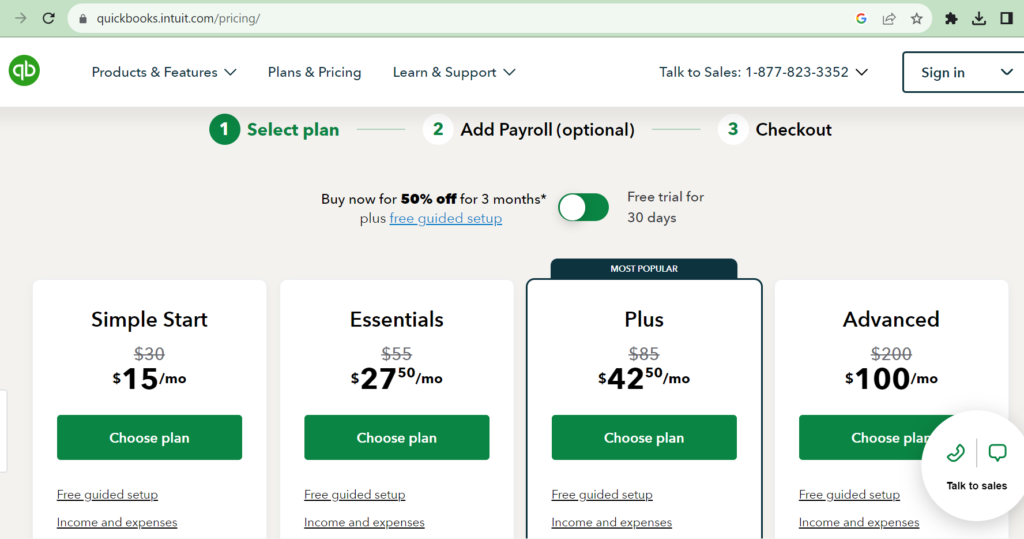

QuickBooks:

- Self-Employed Plan: Designed for freelancers and sole proprietors, offering basic accounting features.

- Simple Start: Basic plan for small businesses, including features like invoicing and expense tracking.

- Essentials: Expanded features for managing bills, multiple users, and time tracking.

- Plus: Comprehensive plan with advanced reporting, project tracking, and inventory management.

FreshBooks:

- Lite Plan: Basic features for freelancers and small businesses with a limited number of clients.

- Plus Plan: Expanded features including time tracking and proposals, suitable for growing businesses.

- Premium Plan: More clients and team members, with advanced reporting and functionalities.

- Select Plan: Custom plan with dedicated support and tailored features, ideal for larger businesses.

Expensify:

- Individual Plan: Suitable for individuals tracking their own expenses, with basic features.

- Team Plan: Designed for small teams with expense reporting, advanced approval workflows, and integrations.

- Corporate Plan: For larger businesses, offering advanced features, policy enforcement, and admin controls.

- Enterprise Plan: Custom plan with additional support, custom development, and advanced features.

For the most recent details on pricing and functionality, be sure to visit the official websites of these tools. Take into account elements like the number of users, the unique requirements of your organization, and any additional features you desire. In addition, some software products provide free trials, which can be an excellent method to determine whether a specific tool fulfills your needs before committing to a subscription.